As we close out the month, we’re thrilled to share key progress highlights from Ndasenda PAY, our platform revolutionising access to credit through salary deduction-based borrowing.

Verified Users: Trust Grows with Every Account

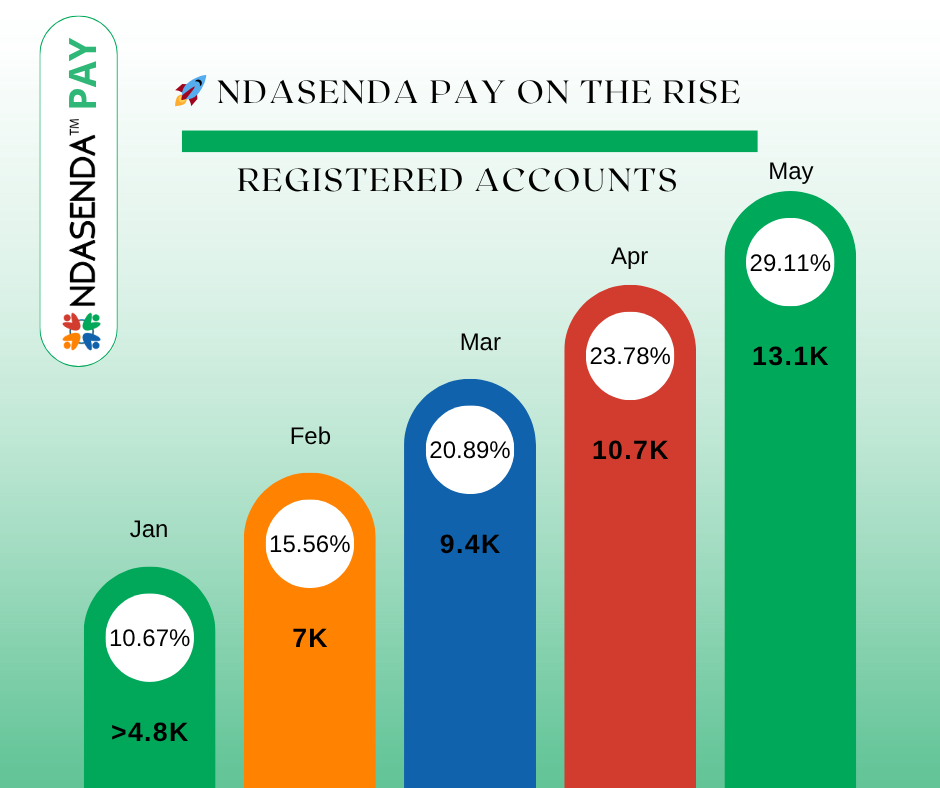

We’ve crossed a new milestone with over 13,000 verified civil servants, pensioners, and private employees now registered on the Ndasenda PAY platform. Each verified user represents someone who now has access to essential products and services, on credit, and without financial strain.

From furniture and medicine to solar solutions, borehole drilling, and agricultural inputs, more individuals can now improve their lives and livelihoods while paying over time, directly from their salary.

Financiers Are Backing the Vision

We’re proud to report a growing pool of active financiers and micro-lenders who have joined the platform this month. This increase reflects growing trust in our digital ecosystem and opens more doors for underserved communities to access affordable, salary-backed credit.

Each new financier is a step toward sustainable lending that bridges the gap between financial services and real-life needs.

Merchants on Credit: Expanding Access to Essentials

Our merchant base has grown, with more suppliers and vendors offering their goods and services through Ndasenda PAY. Whether it's a small medical outlet in Mutare or a solar vendor in Masvingo, more merchants are recognising the power of inclusive commerce through pay-later solutions.

Why This Matters

At Ndasenda, we believe financial inclusion starts with access, not just to money, but to the essential things that drive quality of life.

When:

- A civil servant installs solar power through salary deductions,

- A pensioner secures medical care without needing upfront funds, and

- A private sector employee procures farming inputs on credit,

That’s not just a transaction. That’s impact.

What’s Next?

- Scaling to additional regions across Zimbabwe

- Rolling out financial literacy content for new borrowers

We remain committed to building a digital ecosystem that works for everyone, especially those previously left out.

Let’s continue building a digitally inclusive future together.

Learn more or register today: pay.ndasenda.co.zw

What they say about Ndasenda PAY.

Through Ndasenda PAY, we aim to bridge the gap between access and opportunity through inclusive, salary-dedication-based credit. But don’t just take our word for it, hear from the voices that matter most. In the videos below, you'll meet a civil servant who accessed life-changing services through our platform, a financier investing in communities with confidence, and a merchant growing their business by offering products on credit. Their stories are a powerful reminder that when financial inclusion works, everyone moves forward.

Here is what some of our Customers, Financiers and Merchants are saying;